Introduction

Changing automobile insurance providers may be a pain, but it can help you save money and be better covered. Too many people keep the same insurer for years, thinking it is easier or that staying loyal means better rates — but that isn’t always true. If you want lower premiums, better customer service, or greater coverage, changing providers may be a good idea. This guide takes you through the process step-by-step to make the transition smooth.

Why Switch Auto Insurance Companies

Let us discuss why you should consider the switch before we get into how to switch. Some of the most usual reasons are

Finding a lower rate with the same or improved coverage

Having poor customer service or claims handling with your current company

Receiving a better rate from a competitor, like combining home and auto policies

Significant life events such as purchasing a new vehicle, relocating to another state, or adding a teenage driver

Outgrowing your existing policy and requiring more coverage

If any of these are true for you, shopping around may be time well spent.

Step 1 Research and Compare New Policies

The initial step toward switching is comparing your policy with others. Check beyond the premium — think about what you are paying for coverage.

Important elements to compare are

Liability limits

Comprehensive and collision coverage

Deductibles

Uninsured or underinsured motorist coverage

Medical payments or personal injury protection

Roadside assistance or rental car coverage if necessary

Use comparison websites, deal with an independent agent, or obtain quotes directly from insurers to collect a variety of choices.

Step 2 Check for Discounts

Numerous insurers provide discounts that may reduce your premium. When shopping around for policies, inquire about discounts for

Safe driving

Good grades for young drivers

Low mileage per year

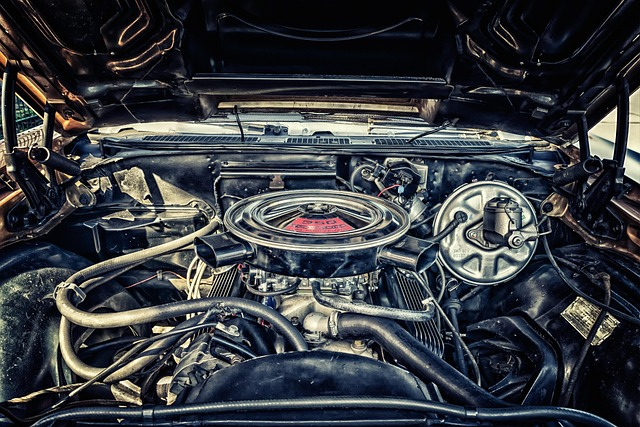

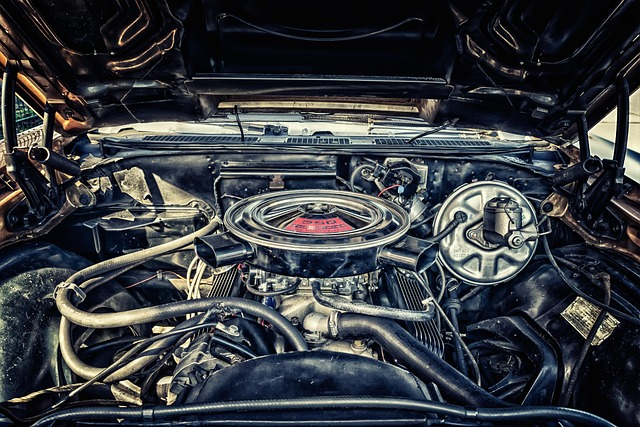

Anti-theft systems or safety equipment on your car

Combining multiple policies such as home or renters insurance

Military service or professional memberships

At times, a discount can make a good quote an even better bargain, so do not skip this step.

Step 3 Review Your Current Policy

Before you cancel your current policy, review the terms carefully to avoid surprises. Check for

Cancellation fees or penalties Some insurers charge fees if you cancel during the policy term.

Refund of unused premiums If you paid six months or a year in advance, you can get a partial refund.

Date of expiration of coverage Knowing your policy termination date allows you to time the transition properly so that you do not have a gap in coverage.

Step 4 Get Your New Policy in Place First

Never drop your previous policy before you obtain a new one. A lapse in coverage, even for one day, may result in

Higher rates when you purchase new insurance — insurers consider lapses to be bad behavior

Legal consequences if you are caught driving without insurance

Financial danger if you are involved in an accident without insurance

Ensure your new policy takes effect and you have a proof of insurance in hand before cancellation of the old one.

Step 5 Cancel Your Old Policy

When your new policy is in effect, it is time to cancel the old one. Contact your existing insurer or provide a written request for cancellation — some companies will need written notice.

When you cancel

Ask for written confirmation that your policy is canceled

Inquire about any refunds you are due

Double-check that automatic payments are cancelled in order not to be charged for the next cycle

Step 6 Give Your New Insurance Details

If your vehicle is financed or leased, your financier or leasing company requires notice of your new coverage. Forward them the updated details as soon as possible to prevent complications.

Also, if your state mandates insurance proof for car registration, ensure that your new policy is on file with the DMV.

Step 7 Keep an Eye on Your New Policy

Following the switch, keep a close eye on your new policy for mistakes. Ensure

Your coverage information is what you committed to

Your billings are correct and payments go through as normal

Any discounts offered are implemented

If something seems amiss, reach out to your new insurer immediately to sort it out.

Common Blunders to Steer Clear of When Changing Auto Insurance

Changing insurance can be easy — if you steer clear of these blunders

Canceling your previous policy before the new one begins Always have continuous coverage to avoid penalties or gaps.

Paying attention to price only Cheaper isn’t always better. Ensure the coverage and customer service are up to your standards.

Forgetting to inform your lender If you lease or have a car loan, not informing your lender of insurance changes can cause problems.

Forgetting loyalty benefits Some companies offer discounts or accident forgiveness to long-time policyholders — ensure you’re not losing valuable benefits by leaving.

Forgetting refunds If you paid in advance for coverage, request a prorated refund when you cancel.

When to Change Auto Insurance Companies

You can change at any time, but some times make the process easier

Before your existing policy is renewed This is when most people change, and you don’t have to pay early cancellation penalties.

After a significant life change Moving, purchasing a new car, marriage, or adding a new driver are all great times to compare.

If your rates increase A premium hike without a clear reason is a good excuse to explore better deals.

After a bad claims experience If your current company mishandled a claim or provided poor service, it may be time to move on.

Conclusion

Switching auto insurance companies can feel like a hassle, but it is often worth the effort. Whether you are in pursuit of higher rates, superior coverage, or superior service, investing time comparing policies and making the change in the right way can pay dividends in the long run and ensure superior peace of mind. The trick is making sure you have a new policy in place prior to dropping the old one — and being vigilant to prevent lapses or charges. If you approach it the proper way, you might get a better bargain and a policy that is ideal for you.